The integration of ESG (Environmental, Social, and Governance) principles into the operations of luxury brands has seen a marked rise of late. Nevertheless, the authenticity of these initiatives is subject to scrutiny and has incited a lively discourse regarding their sufficiency. The question arises as to whom these sustainability efforts truly serve. Are luxury brands pursuing sustainability for the sake of consumers, to satisfy shareholder demands, to meet regulatory requirements, for the genuine benefit of the earth and its inhabitants, or for their own corporate agendas? This article highlights a few major factors driving the integration of sustainability in luxury conglomerate’s corporate strategy.

I. Enhance brand image

Research conducted by the Deutsche Bank in 2023 suggests that luxury goods companies are swiftly moving to the widespread adoption of ESG (Environmental, Social, and Governance) metrics primarily to enhance their public image at a superficial level products [1]. Although genuine efforts and potential tangible outcomes exist, the research implies that some luxury firms adopt ESG practices only to align on results from consumer surveys highlighting the increasing demand for sustainable products [1]. Consumer preferences are shifting towards sustainable products, making ESG metrics a strategic tool for enhancing brand reputation and brand loyalty [2].

II. Societal Activism & Consumer Pressure

More and more luxury consumers prioritize sustainable practices in their purchasing decisions. It is even more true for younger demographics, who view sustainable, ethical, and responsible practices as hallmarks of luxury and quality. In fact, a Deloitte survey found that 57% of luxury consumers consider sustainability a key factor [3]. Notably, younger buyers—Generation Z and Millennials, who accounted for €210 billion of the luxury market in 2022—are leading the change, with expectations for eco-friendly and ethically produced products. By 2025, individuals aged 45 and younger are projected to constitute half of the luxury market demand [1]. Brands that fail to adapt to these evolving expectations risk their market position and reputation, potentially incurring long-term damage. Conversely, those that embed sustainability into their ethos can secure a lasting affinity with a socially and environmentally aware consumer base.

Furthermore, heightened social activism around corporate social responsibility are prompting luxury brands brands to invest in ethical sourcing and environmentally friendly production processes. Incidents like the Rana Plaza collapse have brought significant attention to the working conditions in the fashion industry, compelling brands to scrutinize their supply chains and production ethics more closely. The post-pandemic era has accelerated this shift, with consumers demanding products that are not only luxurious but also socially responsible [4].

III. Investor Pressure

Investor scrutiny has heightened, with stakeholders pressing for robust ESG strategies and transparent ESG reporting as prerequisites for financial support. Deloitte’s report on Global Fashion & Luxury Private Equity and Investors reveals a trend of luxury brands embracing ESG measures to align with investor interests [5]. EY’s corporate survey supports this, indicating that 78% of investors want firms to focus on ESG, even when it may curtail immediate profits [6]. However, the research reveals a significant disconnect between the sustainability expectations of business executives and investors, presenting a risk to capital markets and the broader battle against climate change [6].

IV. Competitive Advantage & Resource Efficiency

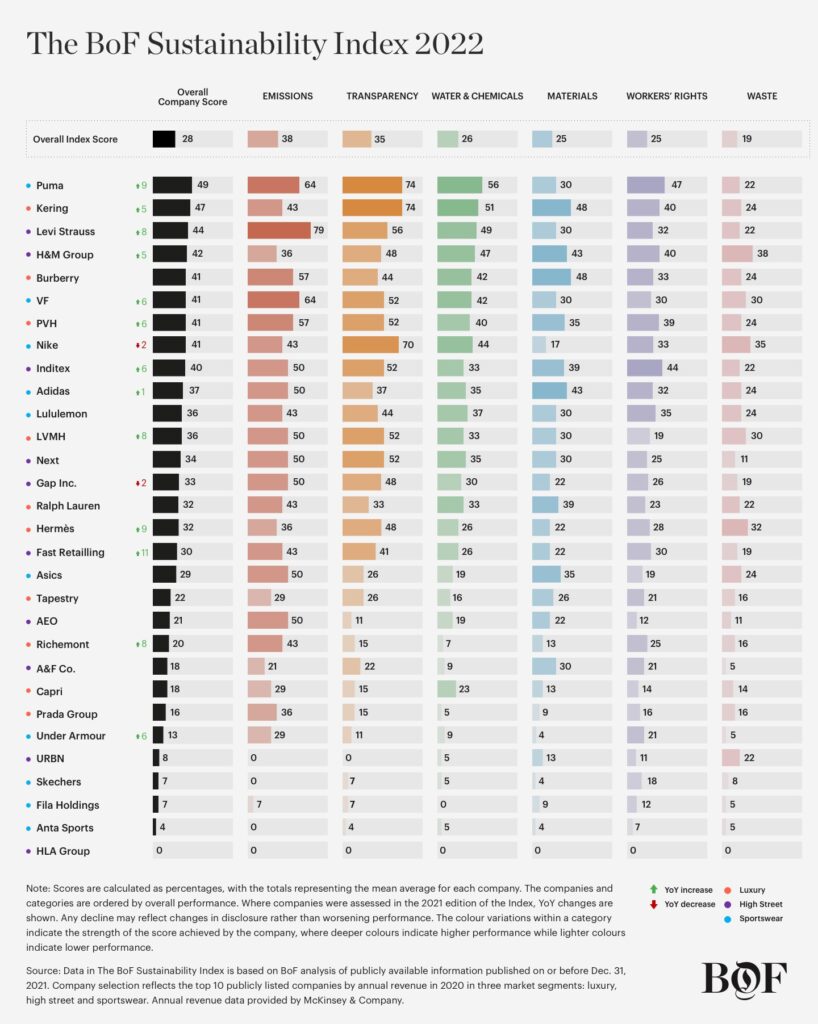

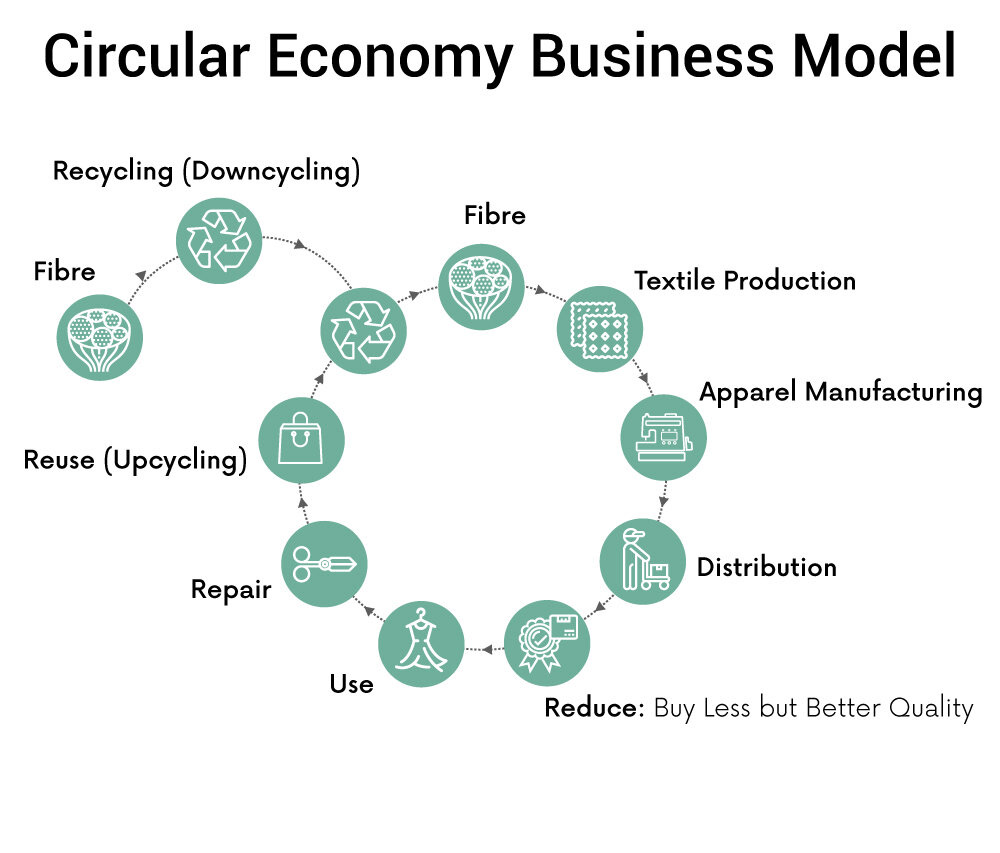

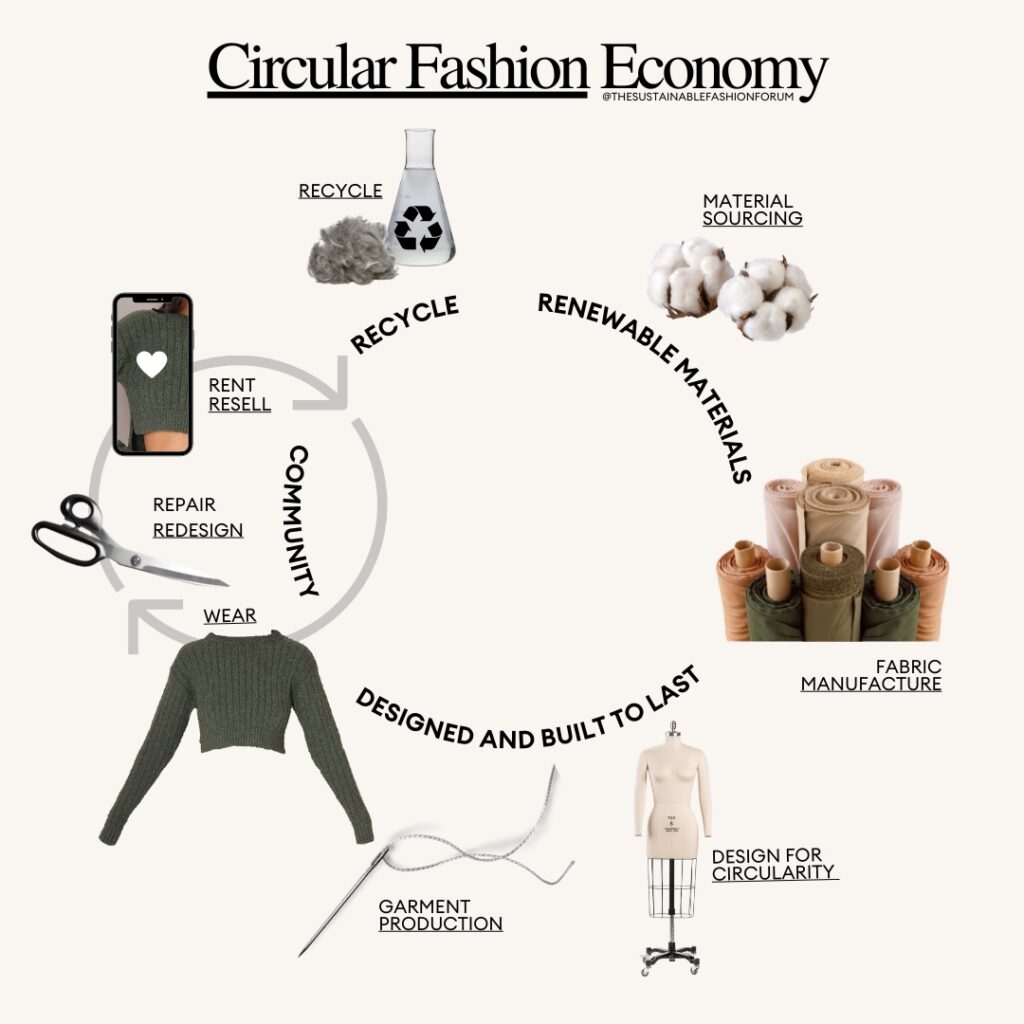

ESG reporting and practices have become fundamental to the competitive strategy of Europe’s major luxury conglomerates in the fashion industry. These businesses gain a competitive edge by fulfilling their societal duties through CSR and actively engaging in Creating Shared Value (CSV) [7]. Incorporating sustainability into brand identity is a powerful way to build positive associations and loyalty, ultimately reinforcing a company’s market position [7]. Furthermore, adopting circular economy principles by minimizing resource use and waste can transform these sustainable practices into core competitive strengths, showcasing a company’s innovation and operational efficiency. Research also points to a tangible link between sustainability and improved financial returns, often stemming from reduced expenditures in energy, water, and regulatory compliance. Cedrola and Trabaldo Togna’s work from 2020 indicates that the pursuit of cost efficiencies often drives firms’ investments in green technologies. Other studies propose that the benefits of sustainable actions extend beyond cost-cutting, strengthening brand identity and facilitating the ability to demand higher prices [8]. Embracing ESG principles can spur a reevaluation of business processes, fostering innovative ways of creating value and attracting financial investments conducive to growth.

V. Stricter Regulatory Landscape

It becomes crucial for companies to not only ensure strict compliance with legal regulations, but also to anticipate and prepare for future sustainability standards. The European Commission’s initiatives, such as the EU Green Deal and the Strategy for Sustainable and Circular Textiles, are setting the stage for a stricter regulatory landscape, compelling luxury brands to adapt. This has been evidenced by Deloitte Survey 2023, which states that C-suite managers of fashion and luxury brands tend to increasingly target their investments in sustainability both to comply with stricter regulation associated to ESG practices and embrace increasing customer demand for more sustainable goods [5]. With over sixteen legislative proposals* discussed by the EU in 2023, brands are under increasing pressure to integrate ESG principles into their operations to meet new industry standards [9].

VI. Adherence to stricter ESG Reporting Standards

Finally, the increasing demand to meet sustainability standards has prompted numerous companies to initiate sustainable programs aimed at both monitoring and assessing their operations and the impact of their activities throughout the value chain [1]. In the context of the “EU Green Deal”, European directives** are issued to improve corporate sustainability reporting standards within the EU, embracing the growing need for firms to disclose transparent and reliable sustainability information. Corporate non-financial reporting serves to communicate a variety of quantitative and qualitative data regarding current and projected sustainability objectives and initiatives, and are mainly directed towards business partners, customers, employees, investors, non-governmental organizations (NGOs), private shareholders, and representatives from various sectors including business, politics, science, and society. Today, the GRI standards stand as the most extensively utilized benchmarks globally for sustainability reporting, with 69% of the top 100 businesses across 49 nations and 72% of the 250 largest revenue-generating enterprises worldwide adopting it, as identified by the Fortune 500 ranking (Threlfall et al., 2020) [7]. The luxury fashion sector also aligns with the 2030 Agenda’s directives to foster sustainable economic development, mindful of environmental and societal impacts [5]. However, it is important to note that critical challenges, including complexity of compliance, data collection and integrity, or sustainability integration with business strategy, might compromise the quality of ESG reporting, which may no longer accurately reflect companies’ activities.

To conclude, luxury brands are increasingly weaving ESG (Environmental, Social, and Governance) frameworks into their core strategies, prompted by a complex mix of internal aspirations and external pressures. While some speculate on the sincerity of these actions, the impetus for such shifts is multidimensional. Nevertheless, it is imperative that corporate ESG reporting and initiatives are genuinely prioritized and approached with intentionality and proactivity. If luxury companies adopt sustainability practices merely to align with regulations or stakeholder expectations—lacking a sincere commitment to long-term planetary and societal betterment—, their potential for making a meaningful impact is significantly diminished. Genuine intentionality and a steadfast commitment to improving the Earth are crucial for identifying and implementing truly optimal sustainable solutions.

* As of January 4th 2024, under the EU Strategy for Sustainable Textiles, three directives have been adopted that still need to be translated into national laws by each member state within a two-year period: the Waste Framework Directive (Directive 2008/98/EC), the Corporate Sustainability Reporting Directive (CSRD), and the Corporate Sustainability Due Diligence Directive. In the meantime, four new regulations have been proposed to the EU textile market, including Eco-design for Sustainable Product Regulation (ESPR), Waste Shipment Regulation, Ban of Destruction of Goods, and Green Claims Directive

** Notable examples of regulations pertaining to ESG reporting encompass the Non-Financial Reporting Directive (NFRD) (Directive 2014/95/EU) requiring more detailed sustainability disclosures from large companies; the Sustainable Finance Disclosure Regulation (SFDR) putting further emphasis on sustainability integration in investment decisions; the introduction of the EU Taxonomy Regulation (Regulation (EU) 2020/852) classifying sustainable activities to guide investment in green technologies; and the Corporate Sustainability Reporting Directive (CSRD) (2021/0104 (COD)) replacing NFRD.

By: Romane Gay

Sources:

[1] Francesca DiPasquantonio; Debbie Jones; Dan Gianera (2021). dbSustainability. Sustainability as the ultimate luxury: how realistic?. Deutsche Bank Research

[2] Regina Connell. (2023). The Luxury Consumer, Sustainability and Social Responsibility:

It’s Complicated. SB.

[3] Faran Krentcil. (2023). Can luxury fashion ever be fully sustainable?. BBC. Retrieved from: https://www.bbc.com/culture/article/20231108-can-luxury-fashion-ever-be-fully-sustainable

[4] Claudia D’Arpizio; Federica Levato; Stefano Fenili; Fabio Colacchio; and Filippo Prete. (2020). Luxury after Covid-19: Changed for (the) Good?. Bain & Company

[5] Global Fashion & Luxury Private Equity and Investors Survey 2023. Deloitte Italy S.p.A.

[6] Emile Abu-Shakra. (2022). Businesses and investors at odds over sustainability efforts. EY. Retrieved from: https://www.ey.com/en_gl/newsroom/2022/11/businesses-and-investors-at-odds-over-sustainability-efforts#:~:text=According%20to%20the%20report%2C%20more,leaders%20hold%20the%20same%20view

[7] MacGregor Pelikánová, R.; Sani, M. (2023). Luxury, slow and fast fashion: A case

study on the (un)sustainable creating of shared values. Equilibrium. Quarterly Journal of

Economics and Economic Policy, 18(3), 813–851. doi: 10.24136/eq.2023.026

[8] Alberta Bernardi; Chiara Luisa Cantù; Elena Cedrola. (2022). Key success

factors to be sustainable and innovative in the textile and fashion industry: Evidence

from two Italian luxury brands. Journal of Global Fashion Marketing, 13:2, 116-133, DOI:

10.1080/20932685.2021.2011766. Retrieved from: https://doi.org/10.1080/20932685.2021.2011766

[9] Co-published by Business Of Fashion & McKinsey & Co. (2024). The Year Ahead: What to Expect as New Sustainability Rules Roll In. Retrieved from: https://www.businessoffashion.com/articles/sustainability/the-state-of-fashion-2024-report-sustainability-regulations-eu-fashion-value-chain/

Image 1

https://images.app.goo.gl/9LzknYDUtTjmiw3c9

Image 2: BOF Sustainability Index 2022

https://images.app.goo.gl/y28Ey5kRWsCb49Zn6

Image 3

https://images.app.goo.gl/RGnaU5jD3RUsUaQAA

Image 4: Altiant Sustainability Luxury Brand Index 2021