(DISCLAIMER: The purpose of this article is merely to illustrate the performance of a luxury company that I care about. I’m not a market guru, manage your money wisely.)

When I buy a bag, I try to expiate my sins (and to forget the negative balance on my bank account) by convincing myself that I’ve made a good investment which is going to last. But you know what? Why don’t’ you make a real fashionable investment buying a stock – of a luxury company, of course?

The company I’m analyzing today is LVMH. Decrypting the acronym, Louis Vuitton Moët Hennessy.

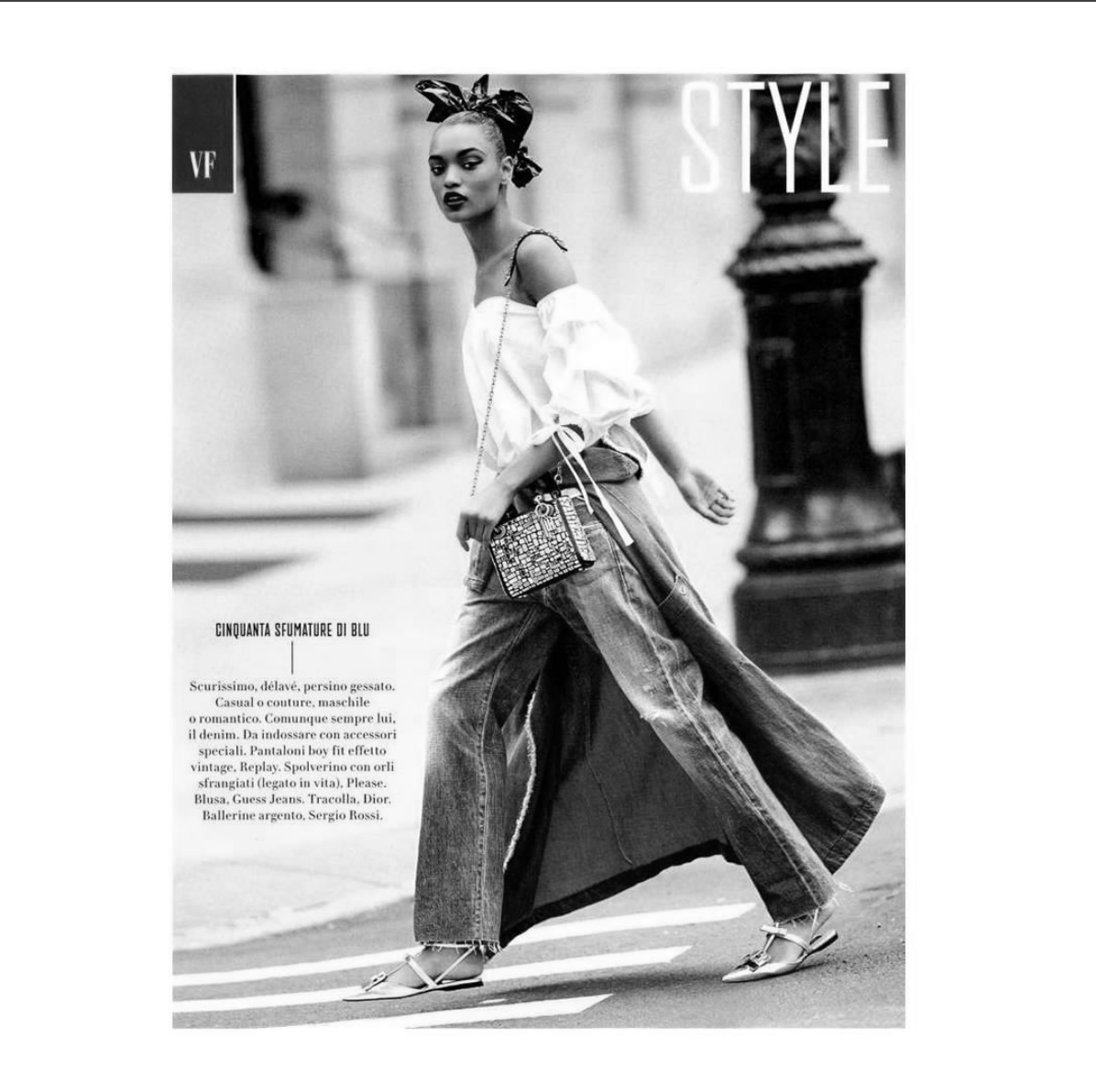

The company, given its fame, doesn’t even need an introduction, but I will do it for the sake of completeness. LVMH is the global luxury group owned by Bernard Arnault operating in five categories: fashion and leather goods, perfumes and cosmetics, watches and jewelry, selective retailing and wines and spirits. Its brand portfolio comprises no less than Louis Vuitton, Dior, Bulgari, Fendi, Céline, Givenchy, Tag Heuer, Sephora and many others names that you dream at night if you’re looking for a job in the fashion industry.

I like thinking that investing in LVMH is as safe as buying a US treasury bill (I’m obviously ironic). Let’s see why.

What bulls say:

BULLET-PROOF BRANDS AND PRICING POWER

LVMH can charge premium prices and earn above-average margins thanks to the luxury status associated with most of its brands, which rely on a 100 year-old brand legacy. Its intangible assets give the group a strong competitive advantage, which ensures 20% operating margins and outstanding returns on invested capital. More easily, LVMH can count on endless brands, which represent the true core of luxury. This allows them to charge premium prices.

Additionally, its enviable plethora of brands has allowed to group to develop precious synergies shared across all brands.

AN EDGE ON COMPETITION

Widely renown for a global expansion lead by product innovation, LVMH has always led the market in terms of expansion in retail location. LVMH has always privileged large cities over smaller cities: this implies stronger sales and lower risk in case of economic downturns.

A NATURAL GROWTH

LVMH last annual report has revealed a 16% growth with revenues of 35,664 million. Most importantly, the group has proved to be almost untouched by the slowdown of China, which is giving a hard time to the luxury sector as a whole. Investing in the group means going for a safer option than most of its competitors. In fact, the size, history, and strength of its brands makes it almost robust to short-term swings in macroeconomics terms. During the past months, LVMH also experienced a boost in sales thanks to the weak euro.

WHAT ABOUT WINES AND SPIRITS?

In the last year, sales in Cognac and in the wine and spirits sector as a whole jumped up. The management disclosed that the sale of Champagne is benefitting from the trend of mixing drinks. Just so you know: your next Saturday night Kir Royal might help the performance of this company.

What bears say:

TOO BIG TO (NOT) FAIL?

LVMH large size could be its ultimate enemy. Will LVMH be able to deliver outstanding performances with so many brands forever? Will the management be smart enough to keep up with fashion tastes and the latest trends given its size?

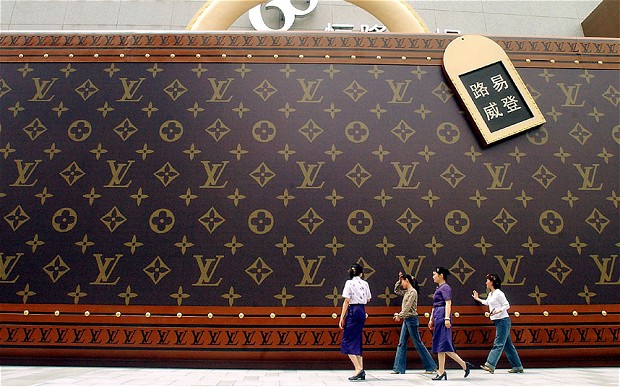

THE MONOGRAM: STRENGTH OR WEAKNESS?

Louis Vuitton is the undisputed star –and cash cow- of the company. Many have been preeching that the brand has become so widespread that it lost its luxury status. Excessive popularity has always been at odds with exclusivity, which is the main pillar upon which the whole luxury concept is about.

Is LV source of fame and recognition (i.e. the monogram, it’s logo) a double-edged sword that will cause its ultimate death?

It’s worth mentioning that Louis Vuitton is steadily delivering a good performance. It seems that the market still loves it.

CONCLUSION

The financial times reported that 18 investment analysts of the best financial institutions covering LVMH believe that the company will outperform the market. Its shares are currently tradinga at 148.50.

This result is due to the amazing group performance and reliable growth: LVMH shares could be a sure bet for a buy and hold strategy.

Think about your next investment: from the additional profits you may get, a Lady Dior could be your next valuable stock.

by Francesca Magri