Much has been documented on the luxury industry’s recent slowdown: its sluggish sales, falling revenues, and creative upheaval since the post-Covid boom ended. Many culprits have also been found to blame: weak Chinese demand, a lack of creativity from designers, and inflation have all been named at fault. Undoubtedly these factors have contributed to luxury’s crisis, but a more subtle offender might have played a large part: luxury’s latest hot trend, price hikes.

Price hikes have always been an essential part of the luxury industry’s business model. Luxury goods in economics are known as Veblen goods, which operate contrary to normal demand-supply economics. For Veblen goods, the rise in price for a good increases its demand due to its existence as a status symbol. This is a well-documented phenomenon that means price hikes are standard in the industry in order to maintain consumption of luxury as conspicuous.

Thus, brands have historically felt comfortable increasing their prices on average by 5-7% each year. For 50 years, customers expected these steady increases, which were already twice the rate of annual inflation. Following the pandemic, these increases shot up to the double-digits, meaning prices of many famous luxury goods have more than doubled since 2019, a Bernstein report found. But following hot consumer demand after covid, brands seized the opportunity to hike prices up far above traditional levels of increases. High prices to cultivate exclusivity, as aforementioned, are necessary, but the issue with the drastic hikes that followed the post-covid boom is that overshooting with price increases is extremely risky. The only thing worse for a luxury brand than raising prices too high is to lower them, or put them on sale. Prices are meant to reflect the exclusivity and quality of an item. When it comes to the last few years, sales indicate that people may be overpaying for the piece or that it’s not the status symbol that they perceived it to be. And although luxury consumers are happy to drop thousands on purchases, they still do not like to think they are being ripped off.

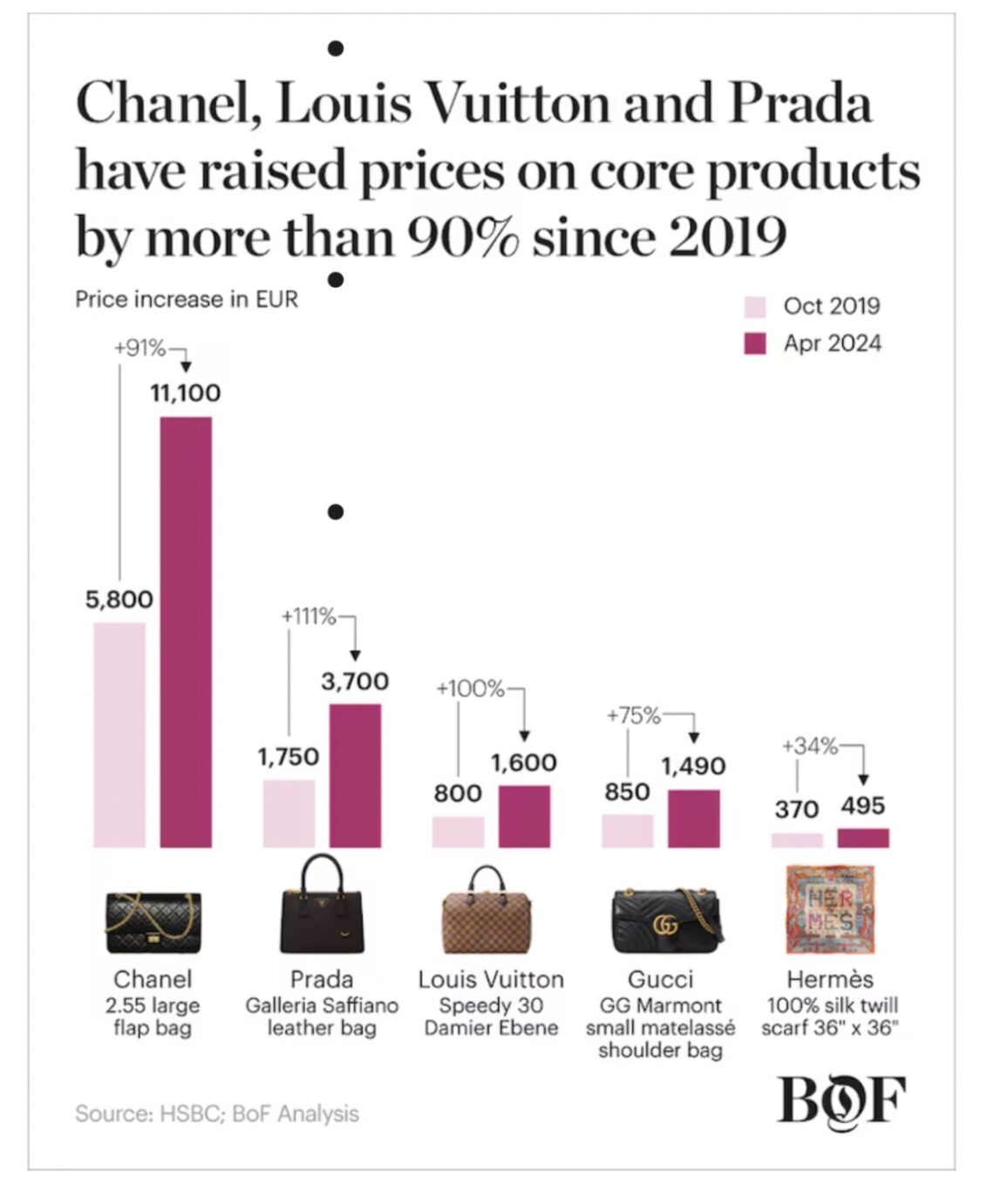

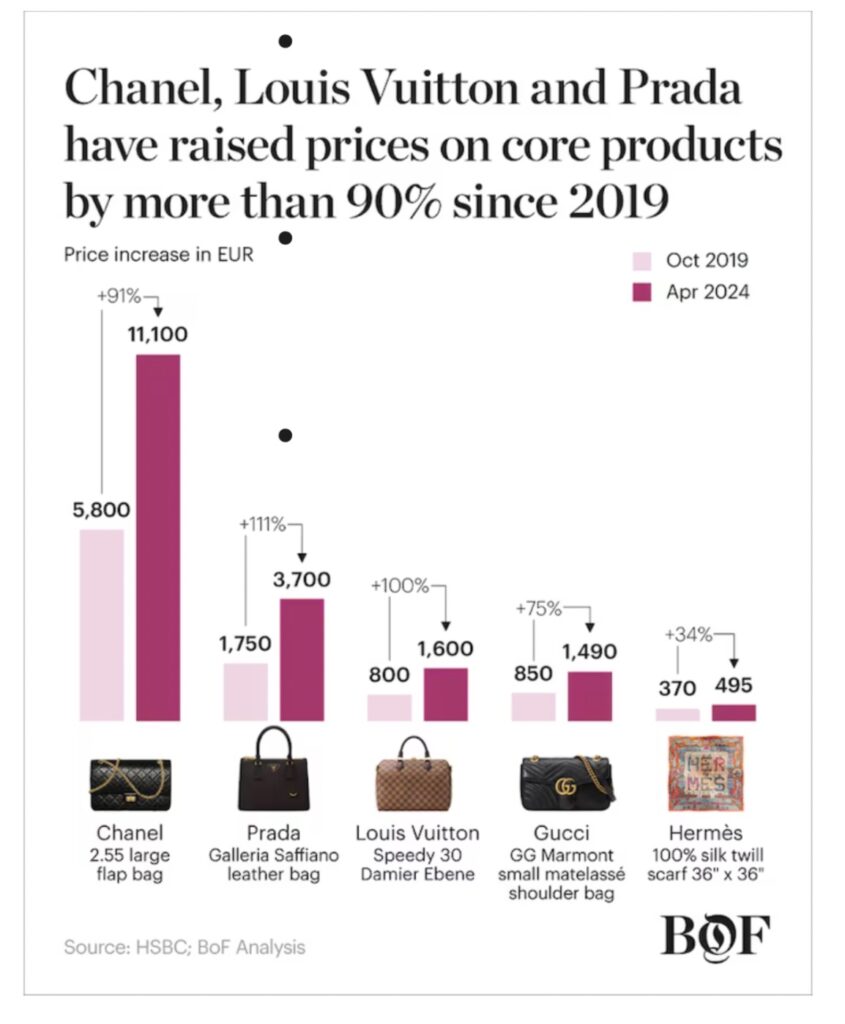

These latest price hikes were explained away by brands as a result of inflation, but a closer look reveals this is not the case. For the past two years the hikes have been far outpacing inflation, even in the worst hit markets. Chanel has been one of the most aggressive perpetrators; a classic medium 2.55 flap bag now costs €11,100, up 91 percent since October 2019. The same goes for Louis Vuitton; the price of a Speedy 30 Bag — made of coated canvas, not leather — has doubled to €1600 over the same period.

A shift over to Italian brands tells the same story: Gucci, which is in the midst of executing an elevation strategy, has increased the price of its Marmont small matelassé shoulder bag by 75 percent, now with a price tag of €1490. Between 2019 and 2024, Prada’s Galleria Saffiano leather bag has increased by 111%, going from 1,750 to 3,700 euros. These hikes are across countries (French, Italian and American brands have all taken part) and styles of ownership; Chanel is a private company, Gucci and Louis Vuitton are owned by major conglomerates, and Prada owned by a smaller public holding.

Maybe if the price hikes were the only thing occurring since 2021, consumers would be more forgiving. Unfortunately, they have been coupled with another large trend in the industry for the past two decades–a shift away from artisanal craftsmen and European production to large Chinese suppliers and warehouses. This shift led to windfall profits for much of the industry, who were able to rely on their reputation for quality to keep prices high whilst cutting down on production costs, generating higher margins than ever before. There was nothing inherently wrong with this shift, but luxury brands continued to advertise their products as high-quality misleadingly. Just this past year, the Italian Competition Authority has launched probes investigating both Dior and Armani for using factories that hired workers under sweatshop conditions.

The Wall Street Journal additionally reported that Dior totes priced at nearly $3000 USD were being assembled for a production cost of $57, whilst Armani priced bags worth $100 at $1,900. Consumers were happy to pay those prices when they thought it somewhat mirrored the value of the item, but felt cheated reading court documents exposing the true cost. Although Dior and Armani are under intense scrutiny, these practices are industry-wide, with stock valuation platform Alpha Spread calculating that average profit margins for these mega-brands are typically as high as 80%.

To achieve such high margins, brands widespread have been compromising on quality. Chanel, for example, has faced increasing complaints from their customers through fashion forums and social media. Frequently-mentioned Issues include uneven stitching, lower-quality leather, and less durable hardware. This decline in quality is heavily linked to the fact that some luxury houses have become mega-brands. Carelessness can easily slip through the cracks now that brands have to rely on both offshoring and multiple supply chains instead of their original Maison alone. This has resulted in situations such as customers realizing their items with ‘Made in Italy’ tags were mostly assembled in China, with just the handles being attached by artisans in Italy. The offshore factories are also often hidden from consumers; the Fashion Revolution’s 2023 Transparency Index found only 52 per cent of the 250 brands monitored declared using Tier 1 factories, classified as production outside the brand’s maison. Ultimately, the misleading marketing that perpetuated quality as justification for their pricing not only increased the interest in going vintage, but started to cause heavy resentment in consumers, aspirational and ultra-wealthy alike.

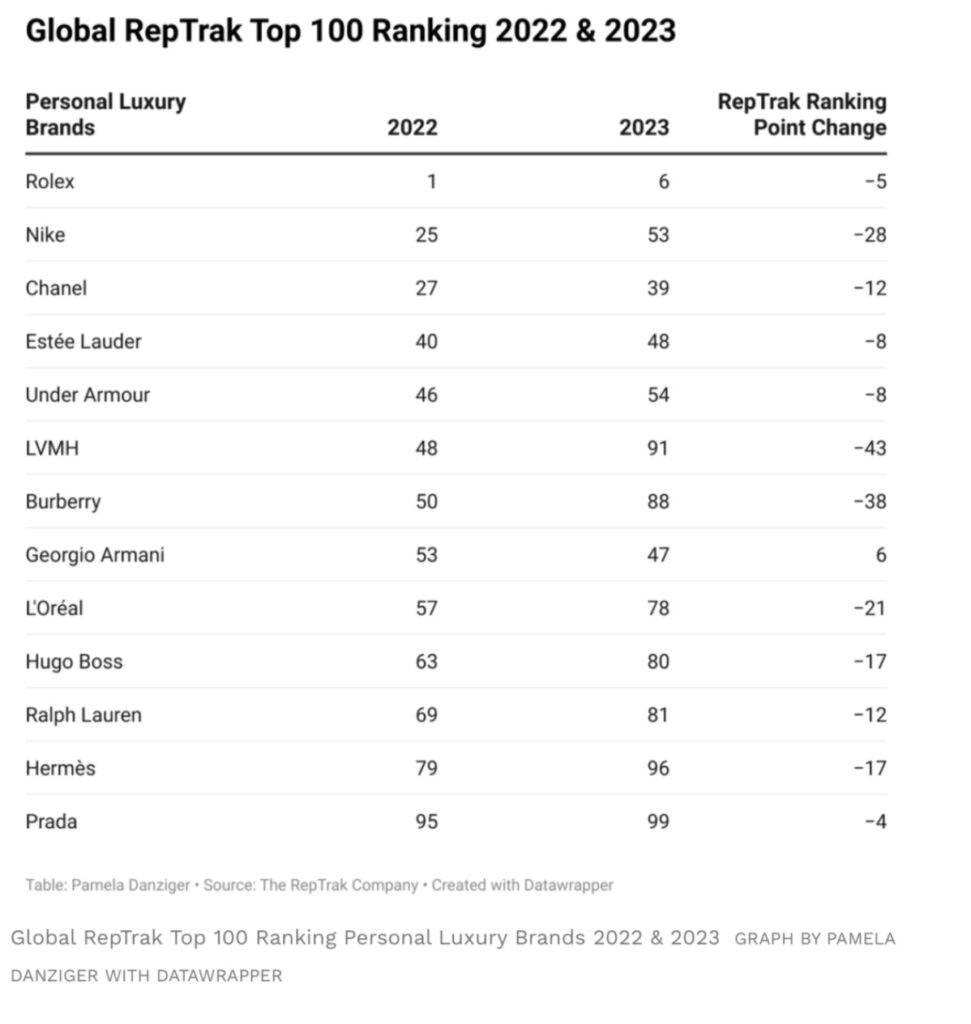

These tactics in pursuit of profit are finally paying their price. Luxury brands observed a decline in trust from their customers. Chanel, which was ranked 27 in the Ranking Personal Luxury Brands in 2022, fell to 39th place in 2023. LVMH plummeted from 48th to 91st, Burberry fell from 50th to 88th, and Rolex hopped from 1st to 6th place. Whether it was a -5 point change or a -48 shift, these brands realized damage had been done to their brand/customer relationships.

One brand stands out from the rest for its continued high-performance as other brands financially flounder: Hermès. Looking at last available data, from Q3 this year, Hermès made $3.9bn in revenue, up 11.3% from last quarter as many of its rivals reported negative growth. Hermès historically has been a brand that has put aggressive price hikes year on year for its products, with a 20% increase on average since the pandemic.

However, its customers continue to come back to deliver profits because it has not cut production costs at the same time. Hermès still has a reputation for luxurious, high-quality for its bags, and it has a favourable and stable value-for-money impression. Hermès has prioritised long-term goals by valuing its customers, promoting a strong brand loyalty that has kept it afloat during the tough economic conditions the industry faces. As the industry looks to Hermès in awe, some are finally lending credence to Hermès’s successful strategy, whilst also realising that not every brand has the luxury of Hermès’s reputation to hike prices up as aggressively and expecting its consumers to stay.

Recently, industry analysts and brands themselves are finally admitting that price hikes–not just inflation–may have contributed to slow consumer demand, and trying to fix the damage. Brands that used to be considered ‘mid-tier’ luxury brands have been the hardest-hit by this price-hike strategy, as their goods’ status is not considered luxurious enough to warrant the new painful prices, particularly when a larger proportion of their customers are aspirational rather than ultra-wealthy. Industry analysts agree that most brands’ price-valuations are out of touch with consumer demand. A prime example was given by Luca Solca, a Bernstein analyst, who noted that now it has “virtually become impossible” to find regular size handbags “at less than $3,000 from reputed brands.” It’s clear that brands are beginning to take this advice into consideration. Speaking to Bloomberg, CEO of British handbag brand Mulberry, Andrea Baldo, committed to bringing most of its bags below a threshold price of £1,100. Another British brand, Burberry, announced plans to price the majority of its bags under £2,000. Michael Kors, its American counterpart, also released a statement promising to bring in a range with price points back within aspirational consumers’ levels, with chairman John Idol admitting that Kors “attempted to elevate price points too quickly over the last two years.”

Another solution might come from the communication of luxury brands, or the way they project their own image. A few weeks ago, the Bocconi Students for Fashion and Luxury Society held a conference on “The Power of Visual Storytelling.” The society invited Andrea Botilla, a freelance brand strategist and author, and Gian Matteo Mellerio, former marketing director at Loro Piana, to speak on the topic. During the meeting, both guests pointed out the difficulty to communicate in the luxury and fashion worlds. They insisted that luxury brands must focus their storytelling on emotional levels, inspiring and connecting their customers to the world of fashion.

On top of lowering their prices, tapping into aspiration and sensibility could surely bring back the trusting relationship between luxury brands and their consumers. Overall, brands have faced difficulties within the market these past few years, whether that was from the pandemic or inflation. This said, their reputations can be uplifted as they rethink their pricing strategies and marketing.

By Mae Panzani & Sienna Jackson

Sources:

https://www.businessoffashion.com/briefings/luxury/luxurys-pricing-reality-check

https://www.businessoffashion.com/opinions/luxury/fixing-luxurys-value-for-money-problem

https://graveravens.com/2024/06/24/chanel-bags-rising-prices-and-declining-quality-spark-shift-to-vintage/https://www.kearney.com/industry/consumer-retail/article/how-the-pandemic-changed-the-luxury-industry