Sunday, 2 December 2018

A few weeks ago, Victoria’s Secret announced new lingerie megastore opening, this time – in Rome, Italy. The news came in as a bit of surprise – in the wake of last summer’s losses in revenue and 55% drop in shares since the beginning of the year, it would seem that L Brands, owner of Victoria’s Secret and Pink, would be too busy implementing changes in business to be stretching the problem to new markets overseas. But can a turnaround happen for lingerie juggernaut? On the day of Victoria’s Secret Fashion Show airing, let’s see if all that glitters is gold.

Victoria’s Secret dropped to their lowest revenues in six years back in summer of 2017 and hasn’t recovered since then. Even though the decline was partially predetermined by shutting down the brand’s swimwear and clothing line in 2016, there are multiple complex reasons behind the slow downfall of America’s number one lingerie brand, that can be summed up by this sarcastic comment from The Business Of Fashion: “It seems no one wants to know Victoria’s Secret anymore”.

Of course, the downsize of interest in the iconic brand is first of all connected to changes in quality of garments, an obvious result of attempting to increase the margin at the expense of fabric and production quality. As a result, many loyal customers are turned off by basic inability to find the same quality they have paid for so long. At the same time, cost cuts seem to be introduced in store management and warehousing as well, as many customers point out that the shops where customers are charged $50 for a bra look unkept and many items are often out of stock. But the cornerstone of this negative trend? Multidimensional loss of relevancy in the ever-growing – and ever-changing – lingerie market.

What springs to your mind whenever you hear the name of the brand? Probably the annual Victoria’s Secret Fashion Show opening the holiday season, with beautiful, sexy models, so ethereal in the length of their legs, the shine of their hair and the dazzle of their smiles that they are deservingly called Angels, and even gracefully carry heavy 20 kg wings to justify the name. The show costs approximately $12 million dollars to produce and, according to VS, actually pays itself off five times, mostly through selling broadcasting rights, ad spots and sponsorship packages. For comparison, an average top brand show during New York Fashion Week can cost as ‘little’ as $ 200 000 to produce.

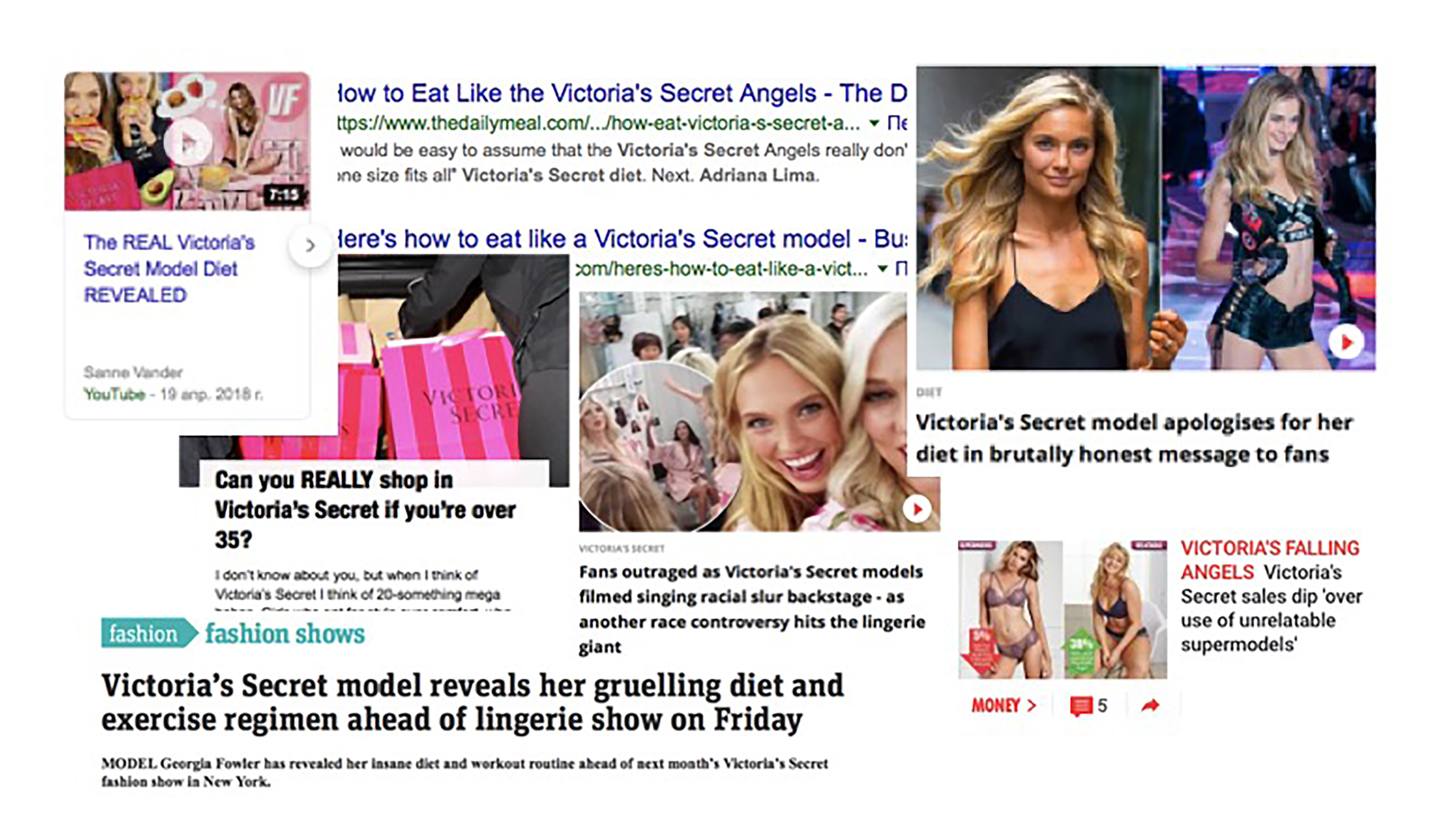

Yes, sex sells – and always will, but how you market it and who you market it to is paramount. It seems as if Victoria’s Secret lives in their own world, which is very glamorous and perfect – in fact, a little too perfect, in a disturbing way. The brand’s media presence is largely negative – Victoria’s Secret is often under fire for outrageously unnatural Photoshop editing, regular tone-deafness (the latest being Victoria’s Secret CMO Ed Razek’s comment on not featuring transgender models on the show – despite requests from consumers – due to the ‘fantasy’ ambience of it, which, apparently, contradicts gender variety), and promoting Angel-packed online content heavily focused on dieting and exhausting workouts – not even on the less controversial territory of make-up and skincare. Not long ago two British YouTube bloggers dived into model Adriana Lima’s pre-fashion show diet of protein shakes that involved water deprivation for 12 hours (in Lima’s case, right before the show), and dubbed the four-day experience as something they ‘wouldn’t wish on their worst enemies’. No wonder so many women are upset – when Adriana Lima, a woman that is otherworldly beautiful on both unretouched polaroids and boxing class selfies has to go through such hardships in order to go from top model to Angel – it’s something that not only does not inspire body positivity, but actually promotes a very unhealthy eating pattern – through the company’s own brand ambassador. But perfection has no limit, right?

Wrong, Victoria’s Secret weakening market share suggests. Main competitor, American Eagle’s Aerie brand, has being outperforming their bigger rival for 16 quarters in a row: Aerie is gaining more authority with younger customers through betting on comfortable bralettes as opposed to heavily stuffed push-up bras that are at the heart of Victoria’s Secret bra line. Adore Me, just a lingerie start-up a few years ago and number nine underwear brand in USA today is stealing Victoria’s Secret’s market share through emphasis on e-commerce, caring customer service, and, most importantly, – a wider size range represented by models of different age, shape and ethnicity. Adore Me is said to sell more every time they feature a curvy brunette model, which is apparently the real mean of actual American beauty.

You may have heard it before and may very well be tired of hearing it, but we live in a post #MeToo world. Today’s narrative when speaking about (and to) women is drastically different from how it was just three years ago. And while women are extensively learning to support each other, longed-legged, skinny-yet-curvy supermodels, no matter how girl-next-door-ish Victoria’s Secret is trying to cast them, are very far from what a majority of women look like. Both millennials and Gen-Zs are extremely woke when it comes to which company values they prefer to support and how they want their wear to represent them, and hypersexualization that always comes with Victoria’s Secret is perceived as something that sets women back in their fight against patriarchic institutions.

Of course, all hope is not lost. Victoria’s Secret is still number one underwear brand in the U.S. and a 7 billion dollar business. It still comprises more than half of L Brands revenues. It still controls over 60% of U.S. lingerie market. It still holds a lot of allure for not only American teenage girls but also for women in developing countries. Noticeably, one of the company’s biggest markets is Saudi Arabia, a country that probably possesses unfortunate leadership in their traditionalist view of womanhood.

But, sadly, it seems like there is not too much that Victoria’s Secret can do to go through their image change safely, except for getting rid of yet another CEO (Jan Singer stepped down mid-November after only two years in position). Sexiness is encoded in the brand’s DNA as key association – remember when Playboy failed to popularise softer aesthetics in their online magazine version? But can the two cases really be compared? Male audience that buys into sex-intensive imagery might be in the process of slow change towards less explicity as well, but this mental change is not driven by men. In the case of Victoria’s Secret, the end consumer is still the woman. And if Playboy still dared to feature a transgender model on their cover last year, Victoria’s Secret can safely go beyond just letting Maria Borges, a model of African descent, grace the runway with her real hair instead of a wig.

So, in the light of continuous lingerie megastore openings (noticeably outside the U.S.), what could Victoria’s Secret be hoping for in Italy when even the Chinese, stereotyped as reckless hype-loving consumers, almost wiped Dolce & Gabbana off their map in one day after one unethical ad and ‘hacked’ Instagram comments? And what does Victoria’s Secret aspiration to succeed in Rome tell us about Italian consumers? Are they still far away on their way to be wanting a better-represented society or are they just really keen on American lifestyle brands? Looking at the lines to the very first Starbucks in Milan that just opened this September, let’s hope it’s the latter.

By Naira Khananushyan