Hermès International, or simply Hermès, was founded in 1837 as a harness workshop by Thierry Hermès in Paris, France. In the 1880s, the company shop was moved to 24 Rue du Faubourg, Saint-Honoré in Paris by Thierry’s son Charles-Émile Hermès, which is now still the firm’s global headquarters. A brand that stresses the importance of heritage remains, until today, an independently family run firm, as compared to several other luxury brands that has been bought out in the past years. (Christian Dior in 2017 by LVMH, Versace in 2018 by Michael Kors)

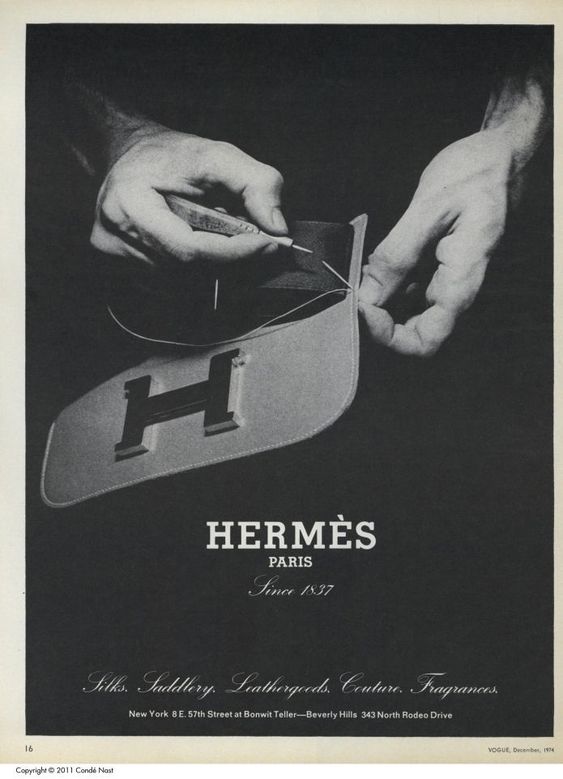

Vogue 1974 via forum.purseblog.com

The fact that the company is presently run by the fifth and sixth generation — the daughters and husbands of Emile-Maurice who is the son of Charles-Emile — decodes why none of those involved in the family business are actually named Hermès.

A brand originally established for serving European noblemen with leather saddlery and gears has grown into this multibillion entity, weighing $49.2 billion, currently under the ownership of the Puech-Dumas-Guerrand family. Synonymous with an “ultra-premium luxury” title of exclusivity, the brand itself serves as the ultimate status symbol. Notably quoting CEO Jean-Louis Dumas, “We don’t have a policy of image, we have a policy of product”. This perfectly captures the brand’s philosophy of being profoundly rooted in quality and craftsmanship, and more so unravels Hermès’s non-replicability.

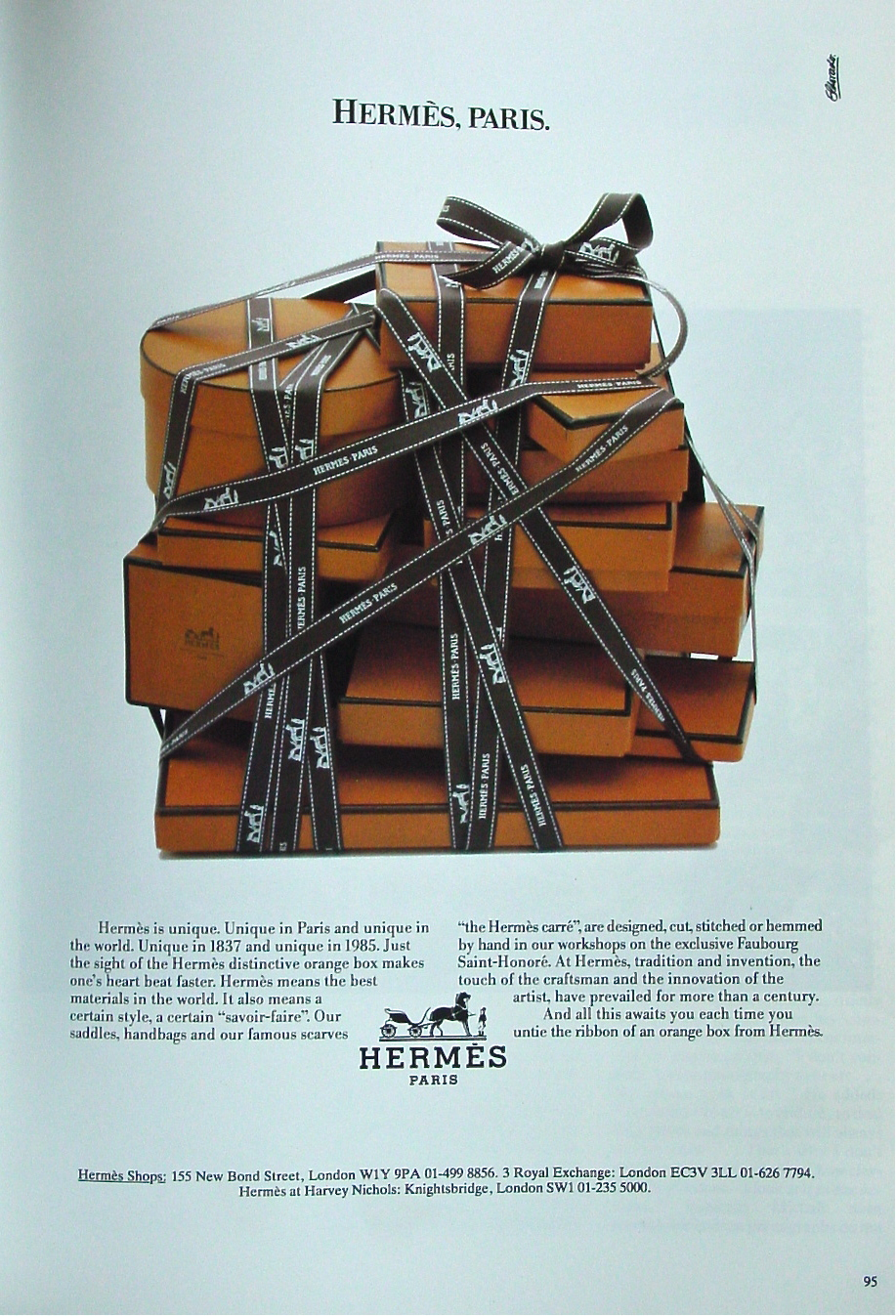

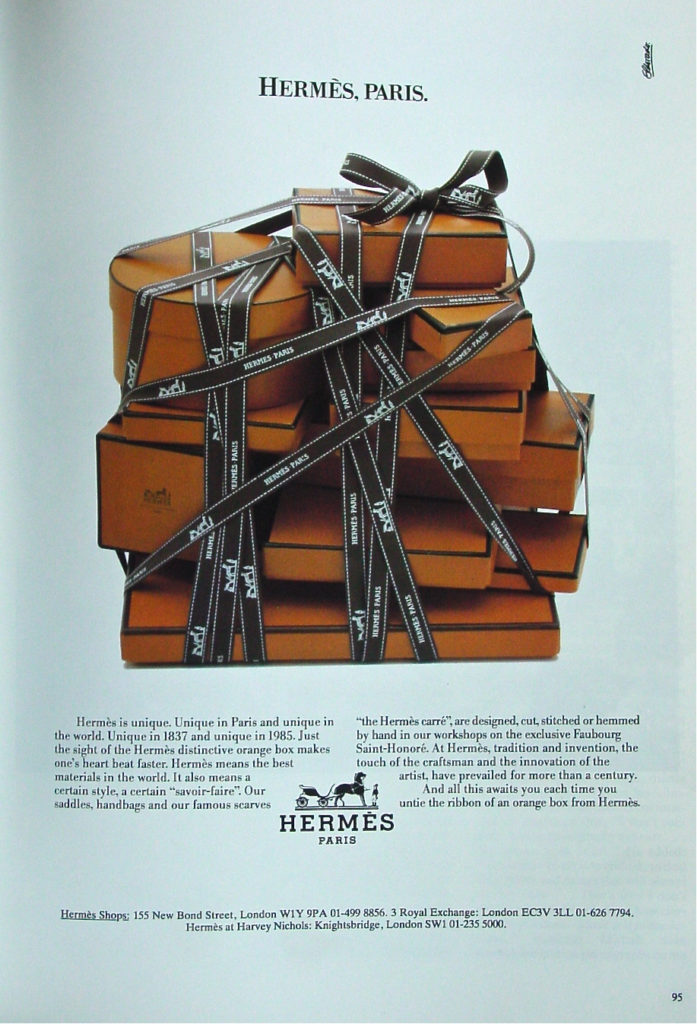

Hermès publicly claims that each product is entirely constructed by one single artisan with an individually stamped code, reflecting the expertise that goes into every piece. The brand further safeguards its uniqueness, both as a business model and a manufacturer, through its loyal, traditional, and wealthy customer base. The group is rooted in a history of incomparable service, superior pricing, and highly centralised process. This naturally captures its target group as they pursue high profits through lower sales quantity.

For instance, it is impossible to directly purchase a bag in Hermès stores due to the limited stock available. Many customers either places themselves into year-long waiting lists or look to second-hand luxury dealers. A study released by BagHunter in 2017 showed that the value of a Hermès Birkin has increased by 500% in the past 35 years. With the recent removal of waiting lists in Hermès stores, the demand continues to climb along an even more limited accessibility.

In the 181 years of Hermès’s running history, it has always shy away from mass production and outsourcing. Hermès implemented a strategy in the 1990s to close down franchises globally by buying them out. As a result, 207 out of the 311 stores now are directly owned and operated by the company. In efforts to preserve the almost-exclusively family controlled company, 73.4% of shares are hold by members of the Puech, Dumas, and Guerrand families. The cohesiveness and consistent stance of the family was even further demonstrated with Hermès’s response to LVMH.

In 2010, the multinational luxury goods conglomerate infamously headlined on the 23rd of October, “LVMH Takes Minority Stakes in Hermès”. Shares that undetectably amounted up to 17.1%, meticulously purchased from Hermès’s subsidiaries by LVMH, became public through Autorité des Marchés Financiers (AMF, English: Financial Markets Regulator). This spurred an immediate counteraction by Hermès in 2011 with the creation of the private holding company, H51. Through pooling together 50+ descendants’ company shares in agreement to halt any selling of shares in the next two decades, they confronted the company’s unwanted shareholder/billionaire Bernard Arnault.

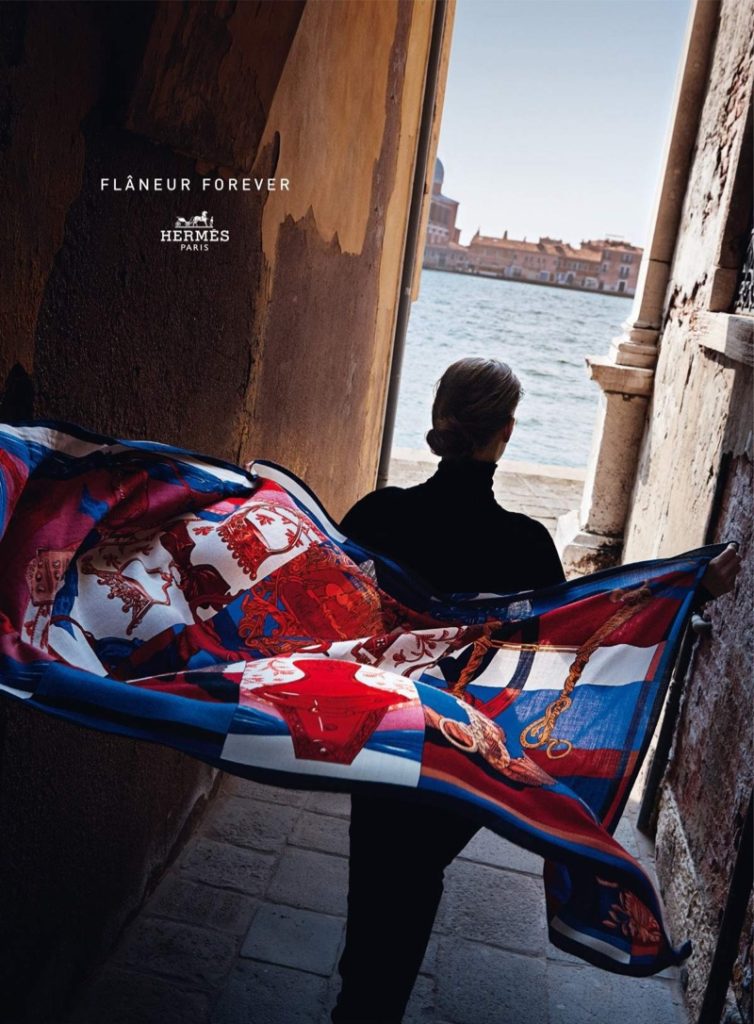

Hermès F/W 2015 Campaign via fashiongonerouge.com

Hermès introduced the concept of patience and the importance of resilience to preserve artisanship. The solid protection of heritage along with the rarity created by its company structure worked hand in hand. In a world where luxury is no longer scarce, and the maintenance of a brand’s exclusivity leans heavily on high prices; The Hermès case study demonstrated how scarcity is now a true form of luxury.

by Ashley Kao