Founded in 1924 by two German brothers, Adidas is the original sportswear brand, originally making shoes for soccer, track-and-field and tennis. From then on, the brand grew exponentially, expanding beyond footwear to become a leading player in both the sportswear and streetwear markets. Becoming one of the most successful corporation in the world, Adidas had to deal with its increasing spectrum of products and countries, which, as one may have guessed, required a few adjustments from the company. Adidas has been much heard of over the past few days, following the announce of their positive financial results over the third trimester of 2016.

At the beginning of November, Adidas publishes its latest financial statements, unveiling a 14% increase in turnover in July-August-September compared to the previous year, that is a 4 billion turnover. Also, following the news of the successor of Herbert Hainer, Adidas’s CEO, the group strongly outperformed the German stock index in the last 12 months. Overall, over the year 2016, we can account for a 14.6% growth, with Adidas aiming at a profit comprised between 975 million and 1 billion dollars.

Surprisingly enough, no less than two years ago, Adidas had a lot of hardships to overcome. Its growth was hampering, it had great exposure to Russia, and its share in the US market was falling to third following the increasing popularity of Nike and Under Armour. However, Adidas won back the spot recently, with increasing sales in North America, China and Western Europe. Let’s have a closer look at the techniques employed by Adidas in its path for recovery.

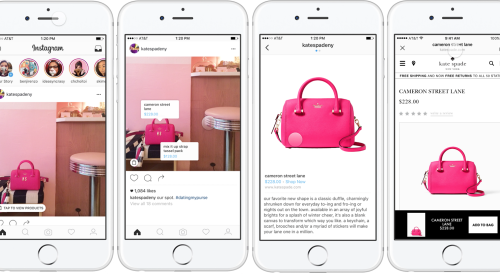

First of all, one of the key foundations of Adidas is its strong corporate culture, built on creativity and innovation. It has set up a « creator » culture, where interaction between employees is fostered, giving birth to innovative projects like « Adidas x Parley », an environment-friendly sneaker, or « Adidas Glitch », a new crampon soccer shoe. Being an open-minded group, Adidas did not hesitate to work with collaborators and influencers like Pharrell Williams, Alexander Wang or Kanye West, with some products of the Yeezy Season collections selling for $1000 on Ebay. In its effort to « look cool », Adidas beefed up online marketing with Instagram and signed more athlete sponsorship deals.

Although the group focuses on novelty, it still strongly relies on its classics to survive. Indeed, two of the main growth drivers are the Stan Smith tennis sneaker, made since the 1960s and the Superstar basketball sneaker, made since 1969.The three stripes’ brand also derives a substantial share of revenues from the sports competitions. It largely benefited from the Euro 2016 and the Rio Olympics.Overall, its growth is mainly driven by Asia and North America, and the footwear lines, which account for as much as half of the company’s revenues.

However, this statement needs to be nuanced. Reebok, part of the Adidas group since 2005, did not perform as well as its parent company. If its sales are not catastrophic, its profits are. Financial markets expressed their worry by strongly sanctioning the group with a 10% fall in the group’s share price in only two days. Even though Adidas recently announced a restructuration of Reebok, uncertainty still weights in on the group, and some analysts like Invest Securities still recommend to sell the brand’s shares. Adidas is also adversely affected by a sluggish sales growth in Russia and Latin America.

Wrapping up, if Nike is, of course, still way ahead of Adidas, its sales are on the way up, and the bets put on innovation may reveal being game-changing for this industry pioneer.

by Marie Motti